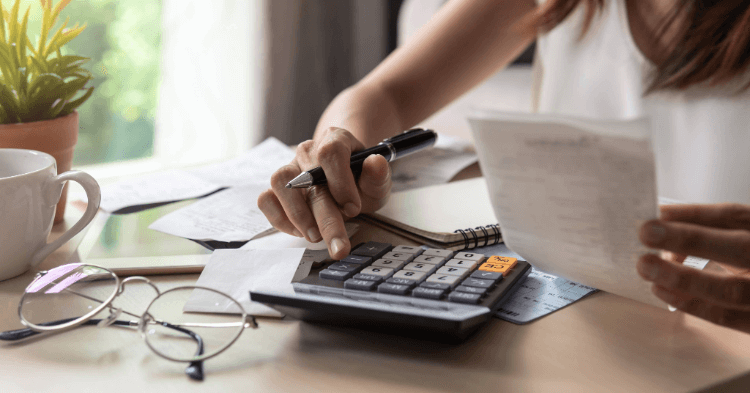

We’ve all made mistakes with our personal finances. But some mistakes have a broader impact on our financial future than others. Aside from one-time mistakes, there are also bad money habits that are tough to overcome. Here are some dangerous financial

habits that Americans make. If you can avoid these bad habits, you’re already a step ahead of the game.

Constantly Rolling Over Car Payments

The amount of financing borrowed for new cars and trucks in 2015.1

The average monthly car payment in 2016.1

Buying a new car once is one thing. But many Americans buy a new car every four to five years. They may justify this because their new car payment may be the same as their old one. A better use of funds is to be able to drive a car for years with

no car payments at all. This either means buying a used car with cash or buying a new car and driving it for longer than the initial loan term. This way, once that initial car loan is paid off, your funds can be spent elsewhere. For instance, you

could contribute money to an account for retirement, college or another goal.

Not Having an Emergency Fund

50%

of Americans couldn’t cover a

$400

emergency expense without borrowing the money or selling something.2

21%

of Americans report that they don’t have a savings account.2

People don’t often think about how much the lack of an emergency fund costs them. But think about how you’d handle various emergencies now if you didn’t have the funds. You’d probably have to borrow money from friends and family, sell something important to you or make other difficult decisions. If you had an emergency fund, you’d be in better control and could avoid derailing any progress you’d made on your budget.

Credit Card Debt Trap

$15,675

in credit card debt.3

of the average household’s income is spent on interest alone.3

Credit cards offer incredible flexibility and convenience, and if used responsibly, can be a positive thing. But often, we let a small monthly overage happen here and there. Before you know it, there’s a recurring debt payment and it gets out of control. The way credit card minimum payments are set up, you can easily go decades making the minimum payment and never catch up. It’s important to close out any recurring debt as quickly as possible so that doesn’t happen.

Making Poor Investment Decisions

of stocks have lost

70%

or more of their value since 1980.4

51%

of Americans are putting off major financial decisions.4

Sometimes people overestimate their own capabilities. The sooner you recognize this tendency and adjust, the more money you’ll save. This is especially true with investments. Most Americans have no better shot at beating the stock market than random chance. However, millions try to do so via trading accounts, buying individual stocks and trying to time the market. The best investing solution for most people is to find the lowest-cost index mutual funds and ETFs and put money there.

References

1 Gardner, G. (September 7, 2016). Car loans now top $1 trillion as delinquency rates rise. Retrieved October 25, 2016, from http://www.usatoday.com/story/money/cars/2016/09/06/car-loans-now-top-1-trillion-delinquency-rates-rise/89911210/

2Frankel, Matthew. (March 11, 2016). The average American’s savings habits – 9 scary statistics. Retrieved October 25, 2016, from http://www.fool.com/retirement/general/2016/03/11/the-average-americans-saving-habits-9-scary-statis.aspx

3Issa, E. E. (n.d.). American household credit card debt statistics: 2015. Retrieved October 25, 2016, from https://www.nerdwallet.com/blog/credit-card-data/average-credit-card-debt-household/

4Schmoll, J. (May 27, 2016). 12 shocking investing statistics and how to change them. Retrieved October 25, 2016, from http://www.investmentzen.com/blog/12-shocking-investing-statistics-and-how-to-change-them/

The information in this article is provided for education and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness or fitness for any particular purpose. The information in this article is not intended to be and does not constitute financial or any other advice. The information in this article is general in nature and is not specific to you the user or anyone else.

[/vc_column_text][/vc_column][/vc_row]