Sticking to a budget can be tough, especially when spending is easier than ever. With a few taps on your phone, you can buy something new, schedule delivery and move on with your day.

But those purchases can add up — and they can take a toll on your finances.

In fact, the conveniences of modern shopping have given rise to a new trend. “Retail therapy” is the act of shopping to relieve feelings like stress, boredom, or frustration. And while buying something new can create a short-term sense of excitement or comfort, impulse purchases can chip away at your budget, drain your savings and make it harder to cover essential expenses later.

To better understand the phenomenon of retail therapy and provide consumers with information to fight it, CashNetUSA surveyed 2,000 consumers about their shopping patterns. The survey was done in conjunction with the survey consultancy Censuswide, and consisted of a nationally representative sample of consumers over the age of 16.

Here’s what we found

Key Findings: Retail therapy in America.

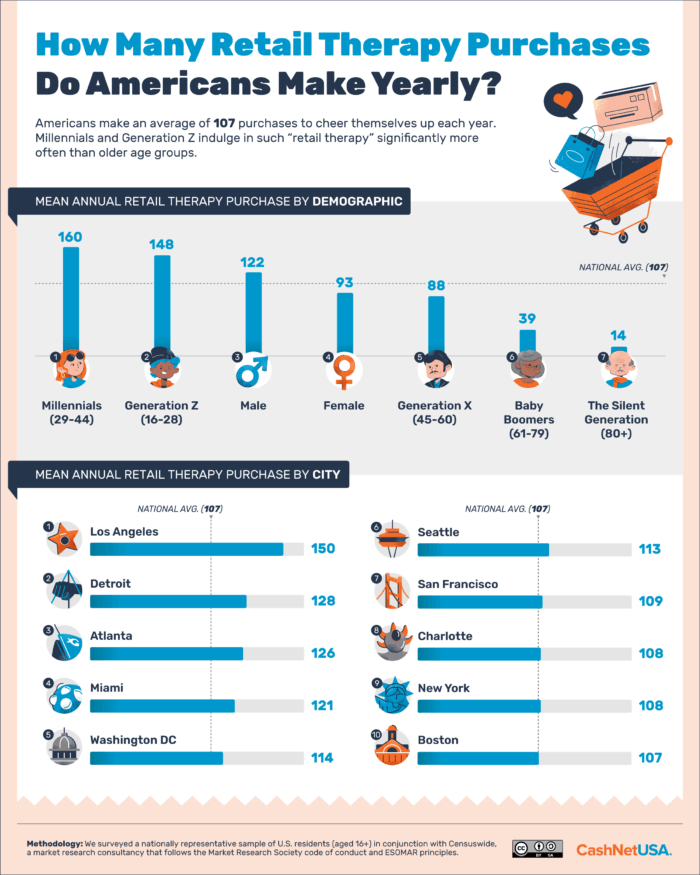

- The average American makes 107 retail therapy purchases per year.

- Millennials (29-44) make an average of 160 annual retail therapy purchases, but for Baby Boomers (61-79), that figure falls to just 39.

- Americans regret 32% of their retail therapy purchases on average.

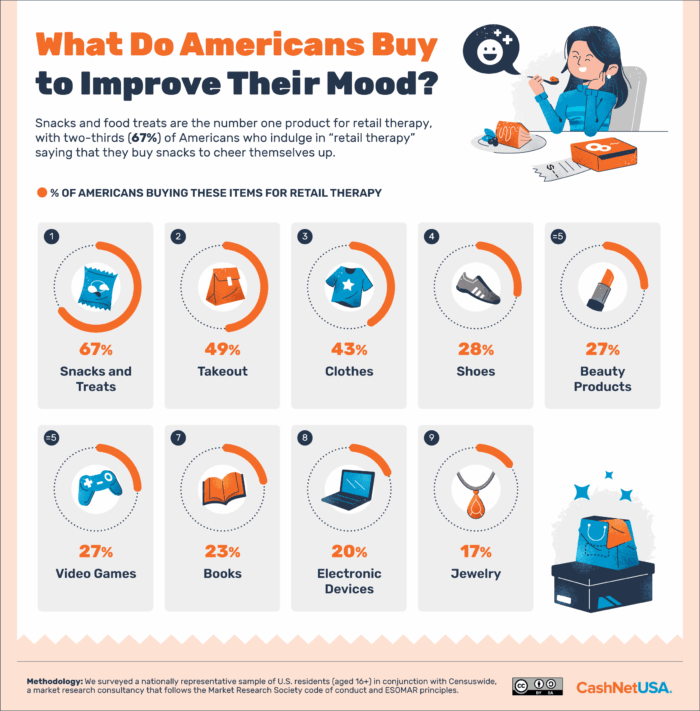

- Food is the most common retail therapy product: 67% of Americans purchase snacks and treats to boost their mood, and 49% buy takeout.

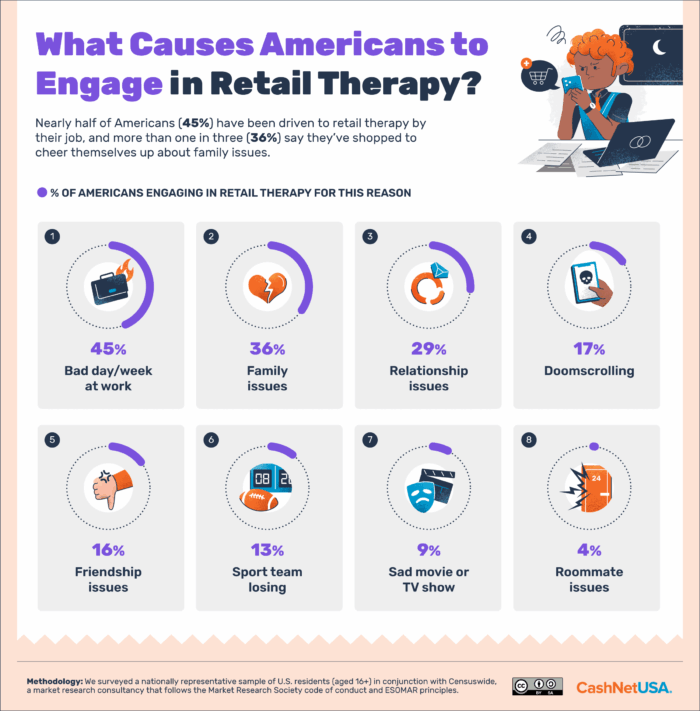

- Some 45% of Americans report shopping to comfort themselves after a bad day/week at work, making it the leading cause of retail therapy.

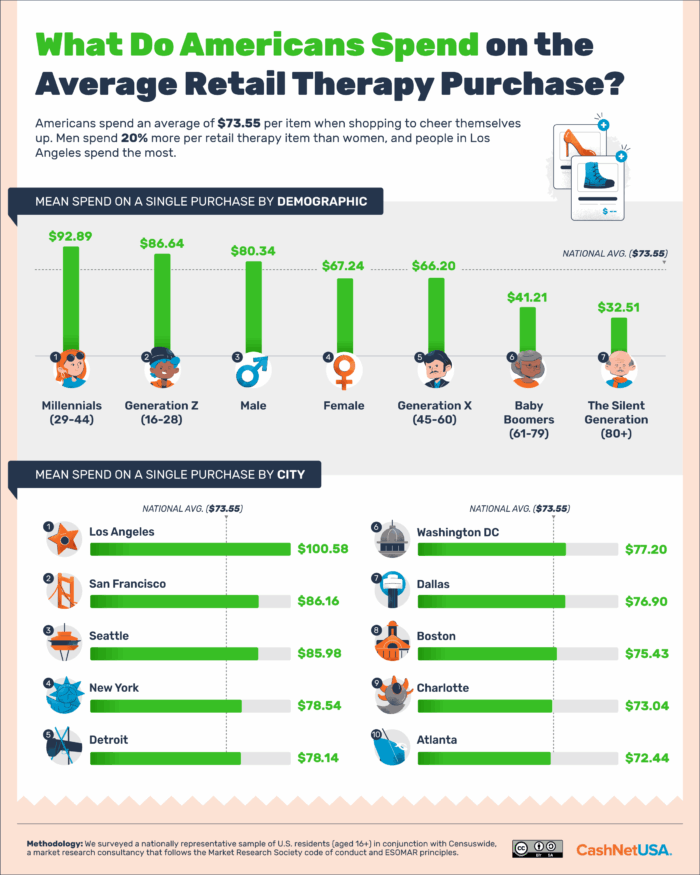

- The average single retail therapy purchase spend is $73.55.

Millennials, men and Los Angeles residents make the most retail therapy buys.

First, we asked respondents to report on the number of retail therapy purchases they made over the past 12 months. The national average is 107 purchases per year. But this figure varies widely between generations and cities.

The youngest generations aged 16 years and over make significantly more than the average number of retail therapy purchases. Millennials (29-44) average 160 purchases per year, Generation Z (16-28) 148, while Baby Boomers (61-79) make 39 and the Silent Generation (80+) just 14.

Younger people may be stimulated to make emotional purchases due to worries such as the “unstable job market, rising housing costs, and the looming threat of a recession,” according to the Summit Wellness Group. Social media influence and the ease of one-click purchasing may also lead to increased therapy shopping.

It is also notable that the average male consumer (122 annual purchases) makes 31% more than the average female consumer (93). “Traditionally, men have less permission to express their emotions openly, particularly vulnerable emotions like sadness, fear or loneliness,” says consumer psychologist Chris Gray, Psy.D. “But when they shop, they can buy their way to meet those emotional needs without openly speaking about them.”

Of the 18 U.S. cities our survey covered, people in Los Angeles make the most emotional purchases (2.89 per person/week), followed by Detroit (2.47) and Atlanta (2.43). The fewest are made in Memphis (1.48), Indianapolis (1.53) and Jacksonville (1.62).

Video games or beauty products, snacks or takeout? Depends on your demographic.

Next, we looked at what people are buying when they shop for retail therapy. By far the leading category is Snacks and Treats, which two-thirds (67%) of Americans over 16 say they’ve bought to boost their mood. Food is clearly an emotional issue, as the second most common category is Takeout, purchased by 49% of Americans as a form of retail therapy.

Takeout is a relatively big deal for younger generations. Some 67% of Gen Z consumers have bought Snacks and Treats to comfort themselves, and 57% have bought Takeout. The gap is much bigger for Gen X and Baby Boomers, of whom ~64% have bought Snacks and Treats, but just 44% and 37%, respectively, have bought takeout as a form of retail therapy. Books rank higher in the list of retail therapy priorities for older generations, and video games rank lower, compared to younger generations.

The gender divide is again apparent when analyzing retail therapy purchases by category. A comparable percentage of male and female consumers shop for Snacks and Treats or Takeout. But for men, the third top buy is Video Games (37%), while for women, Video Games drops to eighth place (17%). Electronic Devices are the other standout for men, with 27% having bought one for retail therapy.

For women, Clothes (49%) and Beauty Products (40%) are the standout categories. “It’ll be like a transformational object, the object of desire that will make things good for them,” Dr. Valerie Steele, museum director at the Fashion Institute of Technology, told Articles of Interest. “I think that is what a lot of fashion is about, hopes and dreams, aspirations, which they hope they get in the right piece of clothing.”

Work is driving people to shop compulsively — but so is doomscrolling.

We asked American consumers what had caused them to indulge in retail therapy. The biggest cause, by a significant margin, was a ‘Bad day/week at work,’ which 45% of Americans report has led them to shop to boost their mood. The second top category is Family Issues, which has driven 36% to shop for retail therapy.

But one emerging trend has become significant enough to warrant its own terminology. Around one in six people (17%) have been driven to retail therapy by doomscrolling, giving rise to the term “doom spending” — spending compulsively to cope with feelings of dread or hopelessness (whether these feelings come from scrolling news and social media apps or real-world experiences).

“Doom spending [is] a display of what we call the passive to active flip,” as Fashion Psychologist Dr. Dion Terrelonge told British Vogue, “with the passive being the many things we may want to change in the world but feel we cannot, and the active being the buying of things.”

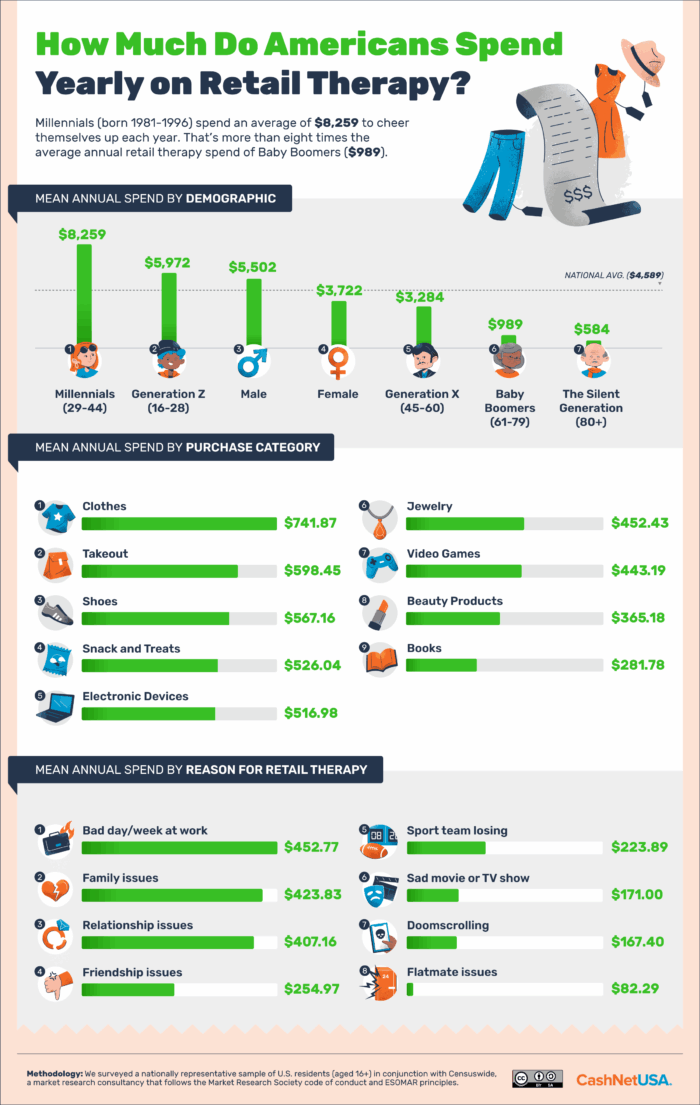

The average American spent $4,589 on retail therapy this year.

So, how much are people actually spending on retail therapy? It is a matter of age. Millennials spend the most annually, at an average of $8,259, which is 33% more than the second-biggest spenders, Generation Z ($5,972) and over eight times as much as Baby Boomers ($989). And while the overall increase in U.S. retail therapy spending in 2025 is only 7%, the rise for Gen Z spending is twice as high at 14%.

Men spend 20% more than the national average of $4,589, and women spend 19% less than average.

If Snacks and Treats or Takeout are the most common choices for Americans indulging in retail therapy (see above), these are relatively affordable splurges; on average, consumers spend more ($741.87) on clothes.

As America’s credit card debt currently reaches $1.23 trillion, the risk of excessive retail therapy is that it can become a cycle, as financial woes compound the strains of work and family life. “The short-term relief from buying something new is often followed by guilt, shame or financial stress,” writes Dr. Daphne Fatter at Mental Health Hotline. “Understanding when spending habits cross the line from occasional indulgence to addiction can help individuals recognize when it’s time to seek support.”

The substantial annual bill for retail therapy tends to add up piecemeal. The average purchase is just $73.55, and even Millennials — the biggest spenders — splurge an average of just $92.89 per item. As such, the frequency of these purchases is what’s most alarming, pointing to retail therapy not as an occasional solution or relief but as an ongoing habit or coping mechanism.

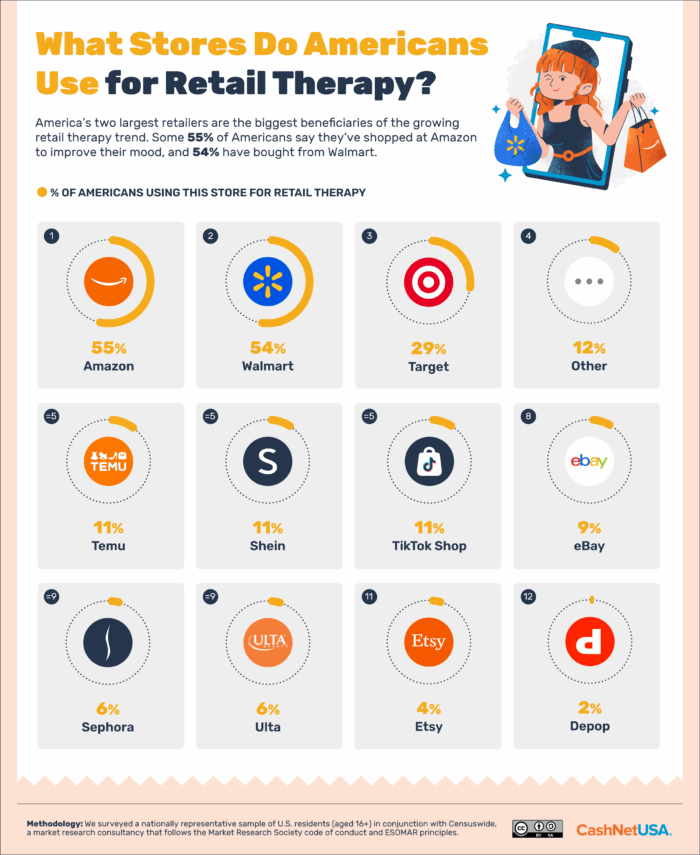

Amazon and fast fashion reap rewards from retail therapy.

Three stores reap the financial rewards of America’s retail therapy habit more emphatically than any others. Amazon is the biggest beneficiary, with 55% of Americans saying they’ve therapy-shopped through Jeff Bezos’ platform. Walmart (54%) and Target (29%) are the others.

Fast fashion also benefits from retail therapy buys, with 11% of Americans having shopped at Temu and 11% at Shein to improve their mood. Independent sellers and resellers, such as eBay and Etsy, rank lower.

With the introduction of Google’s AI-powered ‘vibe-shopping,’ the lure to make emotional purchases may become more compelling. And with people increasingly treating AI like a ‘friend,’ the potential for retailers and algorithms to exploit consumers in their most vulnerable moments becomes more concerning.

How to stay in control of your finances when tempted by retail therapy.

Retail therapy doesn’t need to be expensive. The joy of shopping kicks in before you pay a cent. “It can start before you even leave the house because you’re delighting in all the possibilities,” psychologist Susan Albers, PsyD, told Cleveland Clinic. “Your happy hormones surge through the whole journey.”

To keep your retail therapy costs as low as possible, try the following tips.

- Remove your card details from retail sites. Deactivate one-click buying to put an obstacle in the way of impulse buys.

- Keep a budget and a retail therapy diary. When you see how your spending adds up, you may be discouraged from making frivolous purchases.

- Call a friend. Sharing how you feel and connecting with someone you care about can help put things in perspective.

- Create “decoy activities.” Maintain a list of decoy activities. These should be free activities you love, such as yoga, baths or crafts, and engage in one of these when you feel like indulging in retail therapy.

- Help the community. Making a charitable donation, volunteering or just checking in on a neighbor may release endorphins and help you feel better about yourself.

- Leave it in the basket. When you find yourself on an online checkout page, leave your items in the basket for a cooling-off period — if you really need them, you can come back and pay in a day or two.

Methodology

We surveyed a nationally representative sample of 2,000 U.S. residents (aged 16+) in conjunction with Censuswide, a market research consultancy that follows the Market Research Society code of conduct and ESOMAR principles.

The data was collected between 10/31/25 and 11/03/25.

DISCLAIMER: This content is for informational purposes only and should not be considered financial, investment, tax or legal advice.